Why Debt Service Coverage Ratio Matters in CRE Loan Underwriting

Content

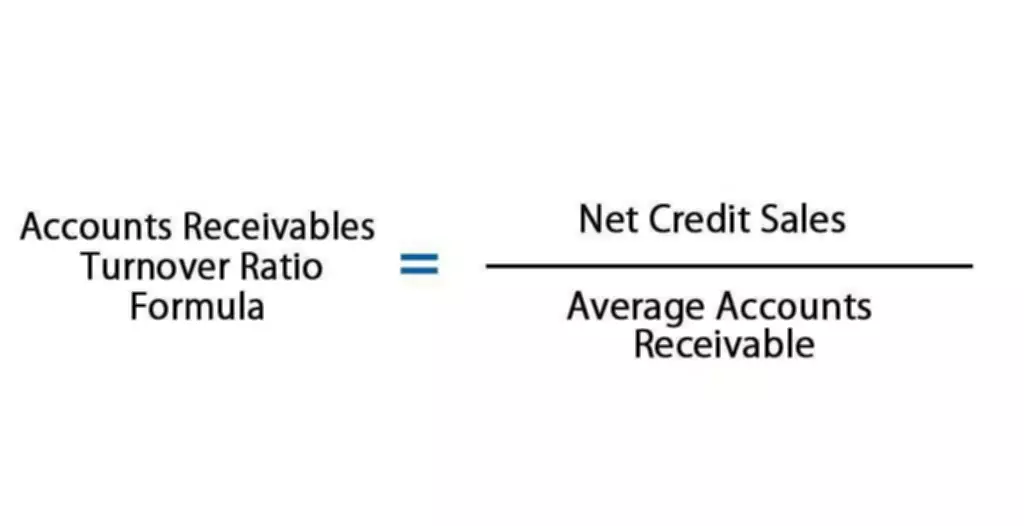

Thedebt service coverage ratio calculatordivides the EBITDA by the value of the minimum debt service requirement. Since the post-tax obligations are greater than the non-cash expenses, the formula used to calculate the minimum debt service required is written in the Description column in the table below.

Fitch Affirms Sapphire Aviation Finance II Limited; Outlook Remains Negative – Fitch Ratings

Fitch Affirms Sapphire Aviation Finance II Limited; Outlook Remains Negative.

Posted: Wed, 30 Nov 2022 22:00:00 GMT [source]

When you calculate DSCR, a higher number is better, since it indicates more latitude to cover debts and shows a business is in a better position to cover repayment of a loan. A DSCR of less than 1 means a business’s cash flow can’t cover its debt obligations and reliably repay outstanding debts. The debt service coverage ratio, often abbreviated as “DSCR”, is an important concept in real estate finance and commercial lending. It’s critical when underwriting commercial real estate and business loans as well as tenant financials, and it is a key part in determining the maximum loan amount. In this article we’ll take a deep dive into the debt service coverage ratio and walk through several examples along the way.

More Definitions of Debt Service Coverage Ratio

One of the most overlooked and misunderstood is the debt service coverage ratio in real estate. A debt service coverage ratio of 1 or above indicates a company is generating enough income to cover its debt obligation.

When a lender looks at an apartment or multifamily property, whether a mortgage will be granted, and for how much, could be determined using the DSCR. The lender isn’t really concerned much with individual credit scores or histories of the owners. The investment’s purpose is return on investment, https://www.bookstime.com/ and more importantly cash flow. For example, let’s say a company has an operating income of $100,000 and pays $10,000 in interest payments and $20,000 in annual debt service. Commercial real estate is one of the biggest industries across our country and is much more complex than you may realize.

Debt Service Coverage Ratio: No-Income Mortgage Loan

A DSCR below 1.0 indicates there is not enough cash flow to cover debt service. However, just because a DSCR of 1.0 is sufficient to cover debt service does not mean it’s all that’s required. As mentioned earlier, DSCR indicates a company’s ability to fulfill its debt obligations. The borrowers may be unable to service the debt without borrowing additional money or raising capital through some other means.