Trading Orders Trailing Stop Order Pending Order Stop Limit Order IFCM India

Contents

But I discovered another big problem today and due to which I might not be able to use trailing stops based on Kijun or MA. The buy stop order is an instruction to your Forex broker to buy the specified currency pair once https://1investing.in/ the price reaches the pre-set price, which is higher than the current market price. When you place a pending order in the Forex market, you are instructing your broker to execute your intended trade at a future time.

Many newer traders tend to view a loss as a negative impact on their trading portfolio or take it person ally as a negative reflection on their ability to trade. Many traders seem to believe that lost money is lost self-worth. A small stop loss taken is a sign of a disciplined trading program that one adheres to. It both instills confidence in your trading ability from an execution standpoint and enhances your reasoning for trading. When one goes back through one’s trading journals and sees how much money is lost due to wider than desired stop losses, he or she will be amazed by the difference.

What is a good stop limit percentage?

Stock Trader explained that stop-loss orders should never be set above 5 percent [3]. This is to avoid selling unnecessarily during small fluctuations in the market. Realistically, a stock could fall by 5 percent midday, but rebound. You wouldn't want to sell prematurely and lose out on potential gains.

So, the sale will be triggered as soon as the price reaches ₹648. Trading order types serve the purpose of instructing the stockbroker on when to enter or exit the trade on behalf of the trader. The order type chosen has a significant impact on the outcome of the trade. Of the many trading order types, a crucial one is the Trailing Stop Loss Order. This order type will sell your automatically stock when share levels drop. Shares can continue to rise and you will stay invested as long as prices do not fall below your stop loss.

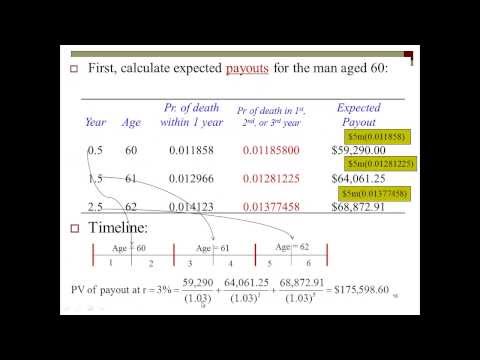

Trading For Corporate Professionals: Exploring the Different Forex Order Types

Now if the market goes to 8568, the stop-loss will become 8548. When investors have an option to put in a trailing stop loss with their stockbrokers or if the investing software offers such a facility. A stop loss order can also be put in manually, but traders who keep a check on their investments regularly should avoid it. If you are a new agent, you can find out how to place a stop loss in grow choice marketing and what things to consider while fixing a stop-loss order on the Grow platform. Grow is an online marketing site allowing the customer to trade various assets from one account. It offers a range of kits and services to help you make the most of your marketing.

- QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website.

- On MetaTrader 5 platform, the activated orders are called Buy Stop Limit and Sell Stop Limit.

- Most major currency pairs have micro lot pip values that are either fixed at $0.10 or that are close to $0.10.

- So I can enter 50 points, or 1000 ticks as my target in the software.

This is an optional feature that you may or may not keep. You can still choose for a normal static stop-loss like you do while placing a cover order. A trailing stop loss can be set at a certain distance from the current market price, for example, 100 pips. So, if you open a buy trade with a 100-pip trailing stop loss, the stop loss will never be further away from the current market price than 100 pips. If the price moves higher, the trailing stop loss will move higher at the same rate as the price. An order is an instruction to your Forex broker telling them how much of a specific currency pair you want to buy or sell, and at the time you want the trade to be executed.

What Are The Techniques For Using Trailing Stop Loss?

Consequently, these are also known as profit-protecting stops. When the price of a financial instrument rises or falls, the stop price moves up or down accordingly. A trailing stop is often used by traders who want to either lock their profits to the upside or to prevent extending losses to the downside.

Similarly, should a short-term price fluctuation in a bearish market lead investors to think a price trajectory reversal is imminent, a buy stop order could prove especially harmful. Assuming one sees a recent string of higher and higher prices for security, an assumption can be made that the particular security is about to increase in price. Therefore it is possible that a trailing buy stop or buy stop order could be executed at the peak of this apparent price hike. The stop loss and trailing stop loss are provided by online brokers to protect their investors from significant losses.

How To Stop Loss In Grow Platform?

Please note as per the exchange regulation of peak margin reporting, peak margin penalty is charged if there is margin shortfall. You can place a bracket order for NSE cash for intraday only. Because the maximum loss is limited,the margin requirements are really low (between 2% and 2.5%) compared to What Ad Valorem Taxes Are, and Why They Matter to You the 10-11% margin requirement in other risk based trades. The world moves too fast and is often too difficult to keep track of. Markets move even faster and in all this turmoil, bracket orders come as a great boon in managing your risks. As the name goes, Bracket orders “bracket” your “orders”.

First of all, there are two directions in which you can trade – long and short . Long positions make money when the price moves higher and short positions make money when the price declines. Before placing a trade, a trader needs to know how much money he is willing to lose on that particular trade. This amount will influence the lot size of the trade and, in certain cases, the distance of the stop loss in pips.

Test your knowledge before trading

Our sales and support team is very transparent in this matter and we do not believe in withholding any information from our clients that might hurt their interest. Let’s say that an investor, Mr B buys 200 shares of ABC Company at Rs 50 each. He places a trailing stop loss order for 10% so that if the market price of these shares drops below 10%, , they will automatically be sold off. A common mistake made by forex beginners is to think that making money with forex trading is a breeze.

Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a high degree of risk to your capital. With a buy trade, your stop loss is placed below the entry price, with a take profit above the entry price. If the price declines and hits your stop loss, you will make a loss; if the price ascends to hit your take profit, you will make a profit. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Stop-loss is a simple yet effective tool that can be used to minimize your losses and lock in your profits.

Some brokers are offering trading plans of unlimited equity trading at 899per month. A trailing stop loss can prove to be an efficacious tool when used judiciously. But it’s essential for all traders to assess the market conditions before setting up this type of stop loss order.

In this case the client may accept the new price for the order to be executed. Trading in the direction of strong trends gives you the best chance to make money in the forex market. The larger time frames (e.g. the weekly and daily) are usually the best to focus on when looking for predominant trends. Technical and fundamental analysis can often give you a good idea of where the market is likely to head and whether large or small market movements can be expected. For beginners, technical analysis is usually a more objective and practical way to assess the current market situation.

There are various types of Forex orders which determine when and how you enter and exit a trade. All the signals made by WinTrader trading system are based on technical calculations and the information available on particular point of time with price. Use proper protections to take the signals, however employees of the site/company will not be responsible for the losses or gains made through the signals, either legally or otherwise. Clients are advised to work out the signals at their own risk.

Can you lose money with a stop limit?

Stop-limit orders have further potential risks. These orders can guarantee a price limit, but the trade may not be executed. This can harm investors during a fast market if the stop order triggers, but the limit order does not get filled before the market price blasts through the limit price.

Day trading is essentially a play on the short-term volatility of a stock on any given day. Day traders buy a stock at one point during the day and then sell out of the position before the market closes. ##THIS SCRIPT IS ON GITHUB This TradingView strategy it is designed to integrate with other strategies with indicators. It performs a trailing stop loss from entry and exit conditions. In this strategy you can add conditions for long and short positions.

Which is better stop limit or trailing stop?

The trailing stop is preferred over the stop limit because there's protection against very fast swings. Since there's a trailing stop set for the end of day, the presence of these cases are already much more minimized. At the end of the day, a loss is a loss.

Along with these features, there is a cherry on top called a trailing stop loss. A trailing stop loss is the dynamically adjusted version of a normal stop loss. It changes the value of a stop loss in your favour when the market is moving in a direction that can earn you profits. It helps you reduce the potential loss that you might incur during online trading.

We shall also not responsible for failure of connectivity of internet and server for any reasons. It is suitable for the clients to act carefully and to double check the informations from other sources before taking any trading decisions and without assigning any responsibility to us. This website does not assure the accurateness or wholeness of any information and is not accountable for any omissions. Trade in stock/commodity/currency market has high risk & high return and we do not accept any financial and/or legal liability come up the use of the software/signals.