A profit-maximizing firm should shut down in the short run if the average revenue it receives is less than: Points : 1 Average variable cost Average total cost Average fixed cost Marginal cost

The marginal revenue curve has another meaning as well. It is the demand curve facing a perfectly competitive firm. If the center shuts down now, revenues are zero but it will not incur any variable costs and would only need to pay fixed costs of $10,000. The cost of production is divided into two parts – fixed costs and variable costs. The break-even point is a point where revenue generated from sales of a product is equal to the production cost . Zero profit is generated at the break-even point.

- The average and marginal revenue curves are given by the same horizontal line.

- This should be given information, as the firm in perfect competition is a price taker.

- A firm that has exited an industry has avoided all commitments and freed all capital for use in more profitable enterprises.

- When a perfectly competitive industry is in long-run equilibrium, all firms in t…

In scenario 1, the center does not have any revenues, so hiring yoga teachers would increase variable costs and losses, so it should shut down and only incur its fixed costs. In scenario 2, the center’s losses are greater because it does not make enough revenue to offset the increased variable costs plus fixed costs, so it should shut down immediately. If price is below the minimum average variable cost, the firm must shut down. In contrast, in scenario 3 the revenue that the center can earn is high enough that the losses diminish when it remains open, so the center should remain open in the short run.

Real-World Application of the Shutdown Point

Firm’s short-run equilibrium is possible in all these three situations. An operating loss reflects unprofitable operations, and changes may be required to decrease costs or increase revenues. A company might also experience an operating loss if it is re-investing in itself to expand business in the future. The supply curve for a firm is that portion of its MC curve that lies above the AVC curve, shown in Panel .

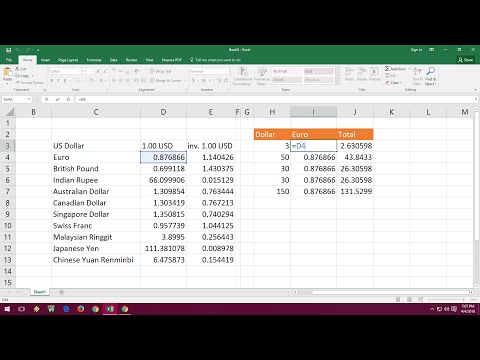

To obtain average revenue , we divide total revenue by quantity, Q. Because total revenue equals price times quantity , dividing by quantity leaves us with price. For example, the break-even price for selling a product would be the sum of the unit’s fixed cost and variable cost incurred to make the product. Thus if it costs $20 total to produce a good, if it sells for $20 exactly, it is the break-even price. The center earns revenues of $20,000, and variable costs are $15,000.

What is breakeven and shutdown point?

The long-run shutdown point is defined by the output corresponding to the minimum average total cost . The long-run shutdown point can be calculated much the same way we did for the short-run shutdown point. We take the derivative of the ATC and solve for Q by setting it to zero.

A business’s fixed costs must be paid regardless of the level of output. It is the output and price point where a firm is able to just cover its total variable cost. Imagine a firm with the TC and TR curves shown in panel of Figure 5 . No matter at what output level the firm produces, the TC curve lies above the TR curve, so it will suffer a loss—a negative profit. For this firm, the goal is still profit maximization.

In the first scenario, the Yoga Center does not have any clients, and therefore does not make any revenues, in which case it faces losses of $10,000 equal to the fixed costs. In the third scenario, the Yoga Center earns revenues of $20,000 for the month, but experiences losses of $5,000. The market price of radishes drops to $0.10 per pound, so MR3 is below Mr. Gortari’s AVC. Thus he would suffer a greater loss by continuing to operate than by shutting down. Whenever price falls below average variable cost, the firm will shut down, reducing its production to zero.

We plug it into the ATC function to get the price. A firm might operate at a loss in the short-run because it expects to earn a profit in the future as the price increases or the costs of production fall. In fact, a firm has two choices in the short-run. Each unit produced generates more revenue than cost, thus, it is profitable to produce than to shut down.

How is total revenue found in a perfectly competitive firm?

A shutdown arises when price or average revenue falls below average variable cost at the profit-maximizing output level. Continued production will incur additional variable costs but will not generate enough revenue to cover them. At the same time, the firm will still have fixed costs to pay, further increasing the losses. In the long run a firm operates where marginal revenue equals long-run marginal costs, but only if it decides to remain in the industry. Thus a perfectly competitive firm’s long-run supply curve is the long-run marginal cost curve above the minimum point of the long-run average cost curve. The optimal quantity of output for the perfect competitor is where marginal cost equals marginal revenue .

In addition, in the short run, if the firm’s total revenue is less than variable costs, the firm should shut down. Is the difference between price and average total cost. At the profit-maximizing output of 6,700 pounds of radishes per month, average total cost is $0.26 per pound, as shown in Panel .

The firm cannot avoid paying fixed costs, whether they operate or not. If they choose to shut down and cease operations, they will generate zero revenue, zero variable costs, and incur fixed costs of $10,000, which means the total loss will increase to $10,000. The long run shutdown point for a competitive firm is the output level at the minimum of the average total cost curve.

If the firm is operating at a level of output where the market price is at a level higher than the zero-profit point, then price will be greater than average cost and the firm is earning profits. If the price is exactly at the zero-profit point, then the firm is making zero profits. However, if price falls below the price at the shutdown point, then the firm will shut down immediately, since it is not even covering its variable costs. Suppose the demand for radishes falls to D2, as shown in Panel of Figure 9.8 “Suffering Economic Losses in the Short Run”.

Shutting down is not the same thing as going out of business. A firm shuts down by closing its doors; it can reopen them whenever it expects to cover its variable costs. It expects to cover those costs the next morning when it reopens its doors. The firm’s economic profit equals economic profit per unit times the quantity produced. It is found by extending horizontal lines from the ATC and MR curve to the vertical axis and taking the area of the rectangle formed. A perfectly competitive firm faces a horizontal demand curve at the market price.

Its variable cost of production is also zero by definition, so the firm’s total cost of production is equal to its fixed cost. The firm’s profit, therefore, is equal to zero minus total fixed cost, as shown above. Any price below the minimum value of average variable cost will cause the firm to shut down. If the firm were to continue producing, not only would it lose its fixed costs, but it would also face an additional loss by not covering its variable costs. In the short run, a monopolist market structure shutdown point is reached when average revenue is below average variable cost at every output level. In such a case, it means that the demand curve is completely below the average variable cost curve.

Average variable cost curve, while in the long run, a firm cannot exit O B. Average variable cost curve, while in the long run, a firm’s exit a firm will shut down in the short run if point is the minimum point on the average total cost curve. Which of the following conditions may or will cause firms to exit an industry?

If the farm shuts down, it must pay only its fixed costs of $62. Shutting down is preferable to selling at a price of $1.80 per pack. How much additional revenue does a radish producer gain from selling one more pound of radishes? The answer, of course, is the market price for 1 pound.

When should a firm operate in the short run?

Mr. Gortari is better off producing where marginal cost equals marginal revenue because at that output price exceeds average variable cost. Average variable cost is $0.14 per pound, so by continuing to produce he covers his variable costs, with $0.04 per pound left over to apply to fixed costs. Whenever price is greater than average variable cost, the firm maximizes economic profit by producing the output level at which marginal revenue and marginal cost curves intersect. As we learned, a firm’s total cost curve in the short run intersects the vertical axis at some positive value equal to the firm’s total fixed costs.

AT WHAT PRICE SHOULD THE FIRM CONTINUE PRODUCING IN THE SHORT RUN?

Shutdown rule In the short run, the firm should continue to produce if total revenue exceeds total variable costs; otherwise, it should shut down. In the short run, when a firm cannot recover its fixed costs, the firm will choose to shut down temporarily if the price of the good is less than average variable cost. In the long run, when the firm can recover both fixed and variable costs, it will choose to exit if the price is less than average total cost. A supply curve tells us the quantity that will be produced at each price, and that is what the firm’s marginal cost curve tells us. The firm’s supply curve in the short run is its marginal cost curve for prices above the average variable cost. At prices below average variable cost, the firm’s output drops to zero.

The firm’s marginal cost curve intersects the marginal revenue curve at the point where profit is maximized. Mr. Gortari maximizes profits by producing 6,700 pounds of radishes per month. As output increases beyond 6,700 pounds, the total cost curve continues to become steeper. It becomes steeper than the total revenue curve, and profits fall as costs rise faster than revenues.

If we make an assumption that these costs cannot be recovered if the firm shuts down then the loss per unit would be greater if the firm were to shut down, provided variable costs are covered. It is where the marginal cost curve intercepts the average variable cost curve. The shutdown rule is a powerful predictor of firms’ decisions to stay open or cease production in the short run. It tells us, for example, why some seasonal businesses—such as ice cream shops in summer resort areas—shut down in the winter, when TR drops so low that it becomes smaller than TVC. And it tells us why producers of steel, automobiles, agricultural goods, and television sets will often keep producing output for some time even when they are losing money. The center earns revenues of $10,000, and variable costs are $15,000.